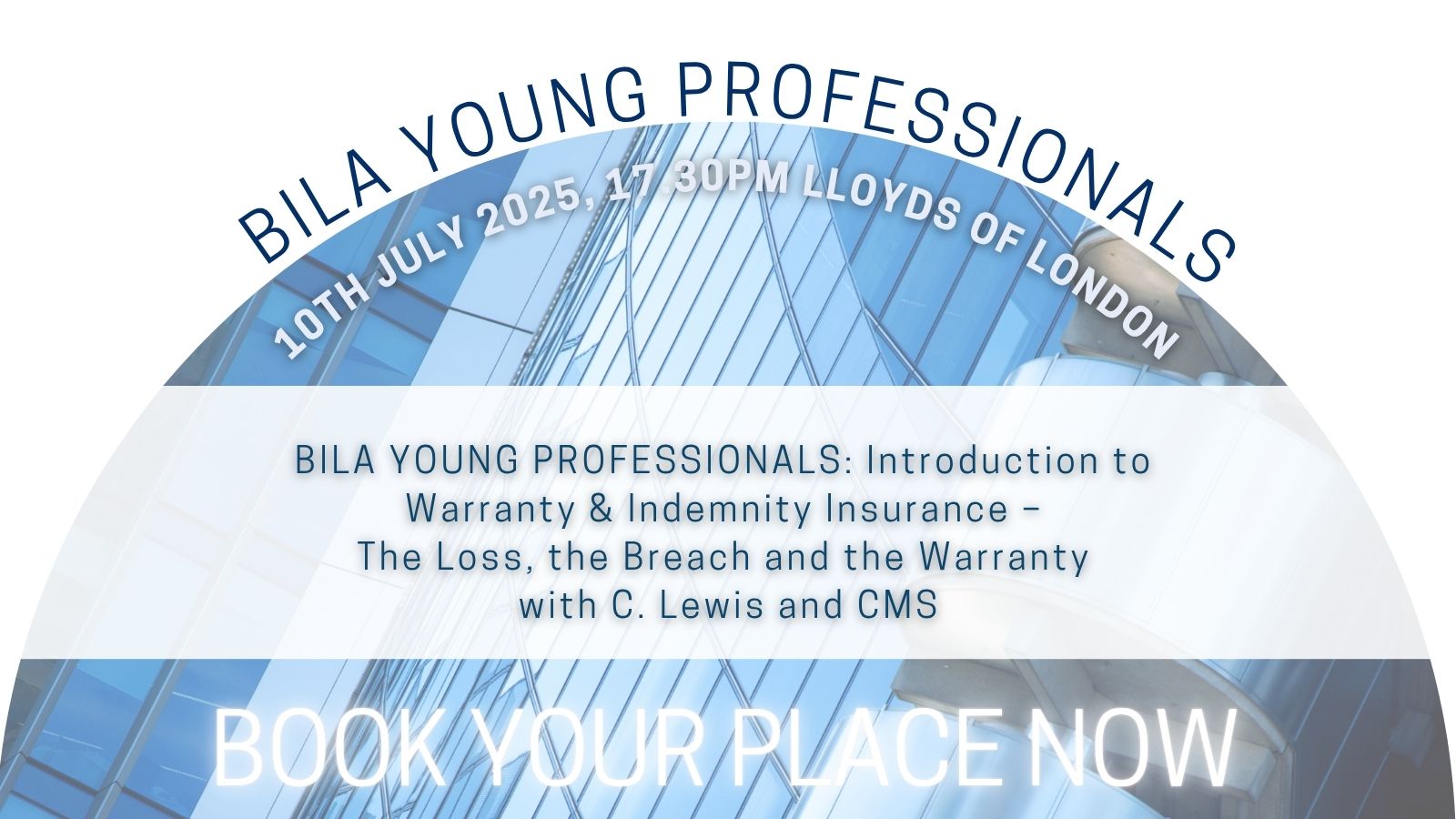

BILA YOUNG PROFESSIONALS

IN-PERSON EVENT

BOOKING FOR THIS EVENT IS NOW CLOSED

Join us for an insightful seminar on Warranties and Indemnities (W&I) Insurance at Lloyd’s of London in the PR1!

Event Title: Introduction to Warranty & Indemnity Insurance

The Loss, the Breach, and the Warranty

Date: 10th July 2025

Time: 5:30 pm (please arrive by 5:30 pm for a prompt start at 5:45 pm)

Location: Lloyd’s of London in PR1

Drinks: Complimentary drinks after the seminar at Bunch of Grapes, Lime Street, London

About the Seminar:

Join experts from C. Lewis & Company, CMS Cameron McKenna, and Convex Insurance as they delve into the complexities of loss under W&I policies. They’ll explore the legal and valuation issues surrounding loss calculation, the role of W&I insurance in M&A transactions, and provide a clearer understanding of how to manage and address breach claims.

Speakers:

Tom Havers (C. Lewis)

Geoff Tan (CMS Cameron McKenna)

Dan Myers (CMS Cameron McKenna)

Kristýna Mühlfeitová (CMS Cameron McKenna)

Arpen Pansari (Convex Insurance)

This seminar is a must-attend for anyone involved in M&A transactions or W&I insurance, offering valuable insights into the practical application of this area of law.

We look forward to seeing you there!

When visiting Lloyd’s, please remember that all external visitors are required to show an original copy of their photo ID (Driving Licence, Passport, Work ID with company logo and full name) when collecting their visitor pass or name badge.

Kindly sponsored by C. Lewis

BOOKING FOR THIS EVENT IS NOW CLOSED

If you require any assistance, please email office@bila.org.uk

We are delighted to have Edije Sodipo giving an online lecture on “The Emergence of a Sector-Led P&I Insurance Model to Build Local Capacity in Africa’s Largest Oil Economy”. This will take place on 1st July 2025 from 1:00 PM to 2:00 PM and will delve into the growing role of local P&I insurance models within Nigeria’s rapidly evolving maritime sector.

Rather than a government-mandated initiative, the drive to localise aspects of P&I insurance is coming from within the industry — from operators, insurers, and legal experts who recognise the operational risks they face and the benefits of having some control over how those risks are managed. This is about aligning economic stake with insurance responsibility, ensuring that those closest to the exposure also have a say and a share in how that exposure is insured. The approach reflects a pragmatic turn, one grounded in law, in market conditions, and in the real economics of marine risk.

The presentation will trace Nigeria’s journey from inherited legal systems to local authorship and show how the evolution of the oil and gas sector, the rise of indigenous operators, and the creation of the Ministry of Marine and Blue Economy have set the stage for what comes next: a sector-led P&I club that reclaims risk, retains capital, and redefines control. The presentation will include:

– overview of the present legal and regulatory landscape in which insurance operates in Nigeria;

– the inheritance of English law and a move towards domestication to foster local opportunity and growth;

– how government policy has helped to reshape the current legal and regulatory landscape as a tool to economic sustainability and wealth creation in the maritime industry;

– opportunities for collaboration.

About the speaker:

Ejide Sodipo is a highly respected authority in commercial and maritime law in Nigeria and is a well-known authority on Protection and Indemnity mutuals. She initiated Nigeria’s Federal Technical Committee for the establishment of a local P&I Mutual.

Ejide has over 30 years of experience in maritime law and her expertise spans cargo claims, charter parties, international trade, bunker disputes and personal injury. She is the CEO of Pye-M Systems, a consultancy firm specializing in mutual advisory and legal compliance in Nigeria’s maritime and energy sectors.

The meeting is summoned by the Committee of BILA. The business of the meeting is (1) to consider and vote upon proposed amendments to BILA’s Constitution pursuant to Rule 17(1) of the BILA Constitution and (2) to elect Rayner Essex to conduct the Financial Statements Review for the year ended 28th February 2025.

The amendments are set out in the Proposed Amendments document signed by the Honorary Secretary. To view the proposed Amendments and current Constitution please login to the member’s area, documents located in the AGM, Minutes and Reports section. If you require assistance, please contact office@bila.org.uk.

Background and Purpose:

BILA’s auditors, Rayner Essex, have advised BILA that they cannot continue to audit BILA’s financial statements at the low fees they have been charging in recent years, particularly since recent planning and procedure changes mean that they cannot strip down the work as far as they have in the past and still remain in compliance with Auditing Standards. Rayner Essex advise that an appropriate review for BILA would be an Assurance Review (under the International Standard for Review Engagements (ISRE 2400)).

An Auditor must give an opinion on whether the financial statements give:

- a ‘true and fair view’ of BILA’s financial state of affairs, and

- have been properly prepared in accordance with proper accounting practice and relevant law.

For an Assurance Review, Rayner Essex would limit work on the financial statements to be able to report that:

- nothing has come to our attention that causes us to believe that the financial statements do not present fairly, in all material respects.

Having considered the issue in detail, the BILA Committee is of the view that an Assurance Review is a more appropriate and proportionate arrangement than a formal audit given (i) BILA’s size and the simple nature of its financial activity, (ii) BILA’s existing financial systems and controls and (iii) the significantly increased cost of a formal audit.

In-Person Event at Lloyd’s Old Library One Lime Street, London, EC3M 7HA

Join Angus Rodger, Chris Paparella, Elise Haverman and Natalia Gofman of Steptoe LLP.

They will discuss the main arguments parties have made in the UK courts to avoid agreements to arbitrate, and the general lack of success of such arguments. They will also discuss a unique arbitration problem that has arisen for insurers in the United States. A number of US states have statutes that invalidate arbitration clauses in insurance contracts. Such statutes conflict with the US’s treaty obligations under the New York arbitration convention when applied to international insurance agreements. The problem is the individual US states regulate insurance but the federal government signs treaties. A number of courts have ruled that the New York Convention trumps the state anti-arbitration laws, but the US Supreme Court will ultimately have to weigh in to resolve the issue for good. The question is complicated by the fact that US federal law provides generally that state laws take precedence over federal law when it comes to insurance regulation.

REGISTER YOUR PLACE

Virtual Lecture

Please Register your place here

We’re pleased to invite you to an upcoming lecture with Professor Matthew Taylor Raffety, a distinguished historian of American and Atlantic history, with a focus on maritime law, diplomacy, and legal history.

In this thought-provoking session, Professor Raffety explores the legal, moral, and financial complexities surrounding the payment of ransoms to marine pirates. He challenges the enduring English legal perspective that views piracy as apolitical “sea robbery,” and warns of the real-world risks this poses—particularly in the context of modern anti-terrorism legislation.

The lecture will address:

- The historical basis for legal ransom payments

- Legal grey areas insurers and negotiators face today

- How ideological motivations by pirates may trigger anti-terror laws

- The need for updated legislation and use of self-insuring P&I Clubs

About the Speaker:

Matthew Taylor Raffety is Professor of History at the University of Redlands, California. He holds a PhD from Columbia University and a law degree from Cambridge University, and is a student member of Gray’s Inn. His research spans legal, gender, and maritime history, with current projects including The Republic Afloat (University of Chicago Press) and a study of the illegal slave trade through Havana in the 1830s.

Don’t miss what promises to be a fascinating and timely discussion on piracy, law, and the complex realities of ransom in the 21st century.

We look forward to welcoming you.

Please Register your place here

VIRTUAL LECTURE – REGISTER YOUR PLACE HERE.

Join us for a talk by Jonathan Scragg, who will be exploring recent insurance contracts law reform – and the resulting newly enacted legislation – in New Zealand.

Jonathan is a partner at Duncan Cotterill in New Zealand and a former president of BILA’s sister organisation, the New Zealand Insurance Law Association Inc.

Jonathan will discuss:

- The politics of insurance law reform in New Zealand;

- The key features of the new legislation – the Contracts of Insurance Act 2024; and

- Some comparisons between the New Zealand legislation and the approach in the UK.

REGISTER YOUR PLACE HERE.

This event will be held in the auditorium of Clyde & Co, The St Botolph Building, 138 Houndsditch, London, EC3A 7AR on 29 April 2025, 2.00 pm – 5.45 pm. To be followed by drinks. The event will also be viewable live online.

PROGRAMME

Opening Address by BILA’s President, James Davey (Professor of Law, University of Bristol)

Panel: Reinsurance wordings – where things go wrong and how they can be avoided, chaired by Özlem Gürses (Professor of Commercial Law, King’s College London)

with:

Sushma Ananda (Barrister, 7KBW)

Peter Wedge (Wordings Director, Gallagher Re)

Jake Fisher (Vice President – Reinsurance, Gard AS)

Panel: ART (cat bonds, industry linked securities, captives, parametric) – perspectives on a changing market, chaired by Dr Caroline Bell (Head of Wordings, QBE Europe)

with:

George Belcher (Partner – Mayer Brown)

Peter Dunlop (Co-founder and General Counsel, Radix ILS)

Carlo Magnani (Managing Director, Aon Securities)

Wynne Lawrence (Partner – Clyde & Co)

Drinks

The event is free to join

REGISTER HERE TO ATTEND VIRTUALLY ONLY – By registering for this event you agree to Clyde & Co processing your personal data for the purposes of facilitating the event. Your personal information will be processed and stored in accordance with Clyde & Co’s Privacy Policy

REGISTER HERE TO ATTEND IN PERSON ONLY – NOW CLOSED

Navigating the AI Revolution: Professional Liability & Negligence in Insurance

Laura Wright and Rebecca Keating of 4 Pump Court

The increasing adoption if AI is transforming industries. As AI adoption accelerates, it brings with it a complex landscape of new challenges and opportunities.

Join us for an talk by Laura Wright and Rebecca Keating of 4 Pump Court (authors of the Professional Liability chapter of the Law of Artificial Intelligence) exploring the critical intersection of AI, professional liability, and negligence within the insurance sector.

Laura and Rebecca will focus on:

– Professional liability risks: The implications for insurers and professionals when AI-driven decisions lead to adverse outcomes.

– Defining negligence in the age of AI: Establishing accountability and responsibility in cases involving AI systems.

– Practices for mitigating risks: Strategies for insurers and professionals to navigate the evolving legal and regulatory landscape.

This presentation will focus on the developments in English insurance (including marine insurance) and reinsurance law in the last 12 month period. This period has witnessed a sheer number of insurance and reinsurance disputes many of which brought questions before the courts that had not been judicially determined before. In a reinsurance dispute the courts for the first time clarified the meaning of ‘catastrophe’ and the application of the ‘hours clauses’ in the context of Covid-19. The care that must be observed in the selection of the standard market wordings was also illustrated through a reinsurance dispute. The courts also clarified whether an excess of loss cover could be regarded as ‘underinsurance’, reiterated the meaning of ‘seizure’ and brokers’ duties to their clients and ruled that the damages against the brokers can be assessed on the loss of chance basis. Moreover, the enforcement of conditions precedent to insurer’s liability under the Insurance Act 2015 was discussed. The marine insurance disputes included the assured’s duty of disclosure and the duty to mitigate the loss, the assured’s knowledge when the assured is a company, fortuity, the enforcement of the ‘pay first’ clause in the P&I club rules, damages for late payment by the insurers, ransom, general average and physical v pure economic loss. Numerous cases continued to discuss the business interruption losses suffered due to the Covid-19 outbreak. The courts reiterated the causation test applied by the UK Supreme Court in the FCA test case in assessing such claims as well as the meaning of the word ‘occurrence’ and how the losses will be aggregated in composite policies.

BOOKING FOR THIS EVENT IS NOW CLOSED

Please join BILA YP at their Winter 2024 Casino Night

Enjoy all the thrill of a Casino along with drinks, nibbles and networking with your peers in the insurance market

10th December 2024

Timings: 17.30 until 21.00

Location: Steam Wine Bar, 1 St George’s Lane, EC3R 8DJ

Tickets £10.00 per person

The full cost of this event is kindly sponsored by Clyde & Co LLP. Proceeds from ticket sales will fund future BILA Young Professionals activities.

Please Note

If you need to cancel your attendance at this event a full refund will be available until Wednesday 4 December. After this time, refunds will not be available but tickets can be transferred into alternative attendees free of charge.

BOOKING FOR THIS EVENT IS NOW CLOSED