In addition to UK members, there are many from all over the world. BILA is not only a domestic organisation, it is also the British Chapter of Association Internationale de Droit des Assurances (AIDA) and is an active participant in all the activities of AIDA including its quadrennial world congress.

BILA is the UK National Chapter of the Association Internationale de Droit des Assurances (AIDA), a not-for-profit organisation founded in 1960 with the aim, through international collaboration, of promoting knowledge of international and national insurance law and related matters of interest.

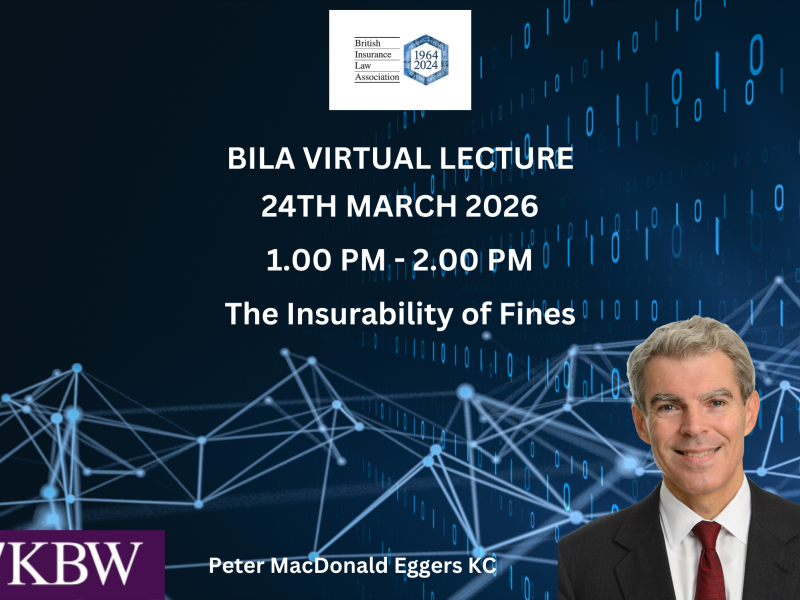

Upcoming events

BILA offers members access to an impressive programme of in person and virtual events all year round, including our annual conference. Bringing together key stakeholders, opinion formers and experts, these events allow members to make valuable connections as well as the opportunity to debate and learn about current legal issues within the realm of insurance law.